Understanding Your Payslip

Written with help from the Money & Pensions Service, who know all the ins and outs of getting paid.

It’s Talk Money Week — a time dedicated to helping people have more open conversations about their money, from pocket money to pensions. Whether you’re in a part time role, fully in the world of work, or just thinking about getting your foot in the door, it’s a good thing to understand what your payslip means when you get it at the end of the month. So, here's some important info about reading your slip!

Getting your payslip…

First things first, don’t be alarmed if you don’t actually get a physical slip of paper with all your pay information! Each month you could get a physical copy, an email, or have to log in to a company website to view it - it just depends on where you work! Everyone, whether you’re full time or part time, is entitled to a payslip every month. The only workers who won’t get them are freelance or contractual workers (as it’s likely you’ll have to do your own instead!)

So what’s actually on the payslip?

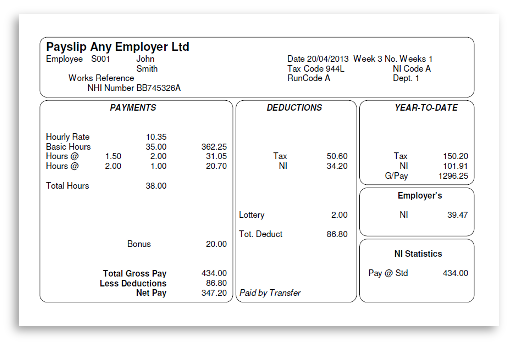

Depending on where you work, you might see slightly different things on your payslip. However, there are some pieces of information that are compulsory for every slip to contain. You’ll find:

Your info: this is things like your name and sometimes your address - always good to double check that the payslip you’re looking at is your own!

Dates: this is the time period that your pay will be put into your bank, and the tax period you’re being paid for.

Gross pay: this is your full pay before any tax or National Insurance has been taken off. You’ll probably notice PAYE on your payslip. This stands for Pay As You Earn. This isn’t anything you have to sign up for, as every time your salary is paid, your employer will deduct income tax and National Insurance automatically through PAYE and pay the amount to Revenue.

Variable deductions: this is the total amount of any taxes or National Insurance that is taken off, which may vary from month to month.

Fixed deductions: this is the total amount of deductions that don’t change from month to month.

Part payments: this is the amount and method of any payments that come in differently - for example separate figures of a cash payment and the balance credited to a bank account.

Net pay: this is the total amount of pay you take home after deductions.

Hours: this is the amount of hours you’ve worked in the month, if your pay varies by the amount of time worked.

There are also a few things that employers don’t have to put on payslips, but you might see on yours. These are:

Payroll number: this is an internal code alongside your name to identify you from anyone else.

Tax code: this is the code given to you by HM Revenue & Customs (HMRC) which tells your employer how much tax-free pay you should get before deducting income tax from the rest. Income tax is used to help fund public services like the NHS, education and the welfare system, as well as investment in public projects like roads, rail and housing. If the code is wrong you could end up paying too much or too little tax, so it’s important to check this against your latest tax code notice!

National Insurance number: this is a unique code to you, to make sure that your National Insurance contributions are correct and paid against your name. National Insurance is similar to income tax, but helps pays for state benefits like retirement pensions, maternity leave, jobseekers allowance, and child benefits.

Pay rate: this is how you get paid, whether that’s hourly, weekly, monthly, or annually.

Extra payments: this is any amount of money you’d get paid for things like overtime, tips, or bonuses. It will also be included in your gross pay amount.

Student loans: this is the amount of your student loan you pay off every month. Thankfully, HMRC will tell your employer how to take off the right amount from your salary, and tell the Student Loans Company what you have repaid.

Why do we actually get payslips?

First off, they’re proof that you’re actually getting paid, and act as a record of how much and when! This means if you have any queries, or notice any discrepancies in your bank account, you can refer back to the slip and ask questions.

It’s also good to keep a record of your payslips as sometimes when you apply for things like loans, or when you start renting a property, you’ll have to prove that you earn a certain amount of money and will likely be asked for a three month record. So having them to hand makes it a lot easier!

Got more questions?

Head on over to the Money & Pensions Service for more info on your payslips and all other money mysteries!