Get up to speed on tax

Tax: what is it anyway?

Only two things in life are guaranteed: death and taxes. While none of us can predict when our demise may come, we do know that once we enter the world of work we’ll have to pay tax. That’s because tax is something that individuals and companies are legally required to pay.

What types of taxes will you pay??

Depending on the twists and turns that your life takes, and whether or not you’re an employee or start your own business, there are various taxes you’ll need to pay. Some of the most common taxes for individuals are:

- Income Tax. Once you start making more than £12,570 a year, this tax will automatically be deducted from your salary.

- National Insurance contributions (NICs). This is a type of tax that’s taken from your salary (or your profits if you’re self-employed). It’s classed as a form of social security because paying it means you’re eligible to claim benefits like a state pension and maternity or paternity pay.

- Council Tax. Most households pay this to their local council.

- Value Added Tax (VAT). This tax is included in the price of most goods and services. So whether you’re buying a lunchtime sandwich or a holiday, you’ll be paying VAT.

- Fuel Duty. This is added to the price of fuel, such as petrol.

How much income tax will you pay??

The amount of Income Tax you’ll pay will depend on how much you earn — which will usually depend on the type of work you do. For example, the average salary for a shop assistant is £24,000 a year, while a solicitor will earn on average around £48,000.

Whatever job you do, you won’t pay any Income Tax on the first £12,570 of your annual salary! But as soon as you earn more than £12,570 in any given year then you’ll need to start paying it.

There are three rates of Income Tax: 20%, 40%, and 45%. You’ll pay the basic rate of 20% on any earnings between £12,571 and £50,270. On earnings between £50,271 and £125,140, you’ll pay the higher rate of 40%. And you’ll pay 45% Income Tax on any earnings over £125,140.

With all the different rates of Income Tax, it can be tricky to calculate how much you’ll pay. Thankfully there are lots of tax calculators online to help you out!

Where does your tax go?

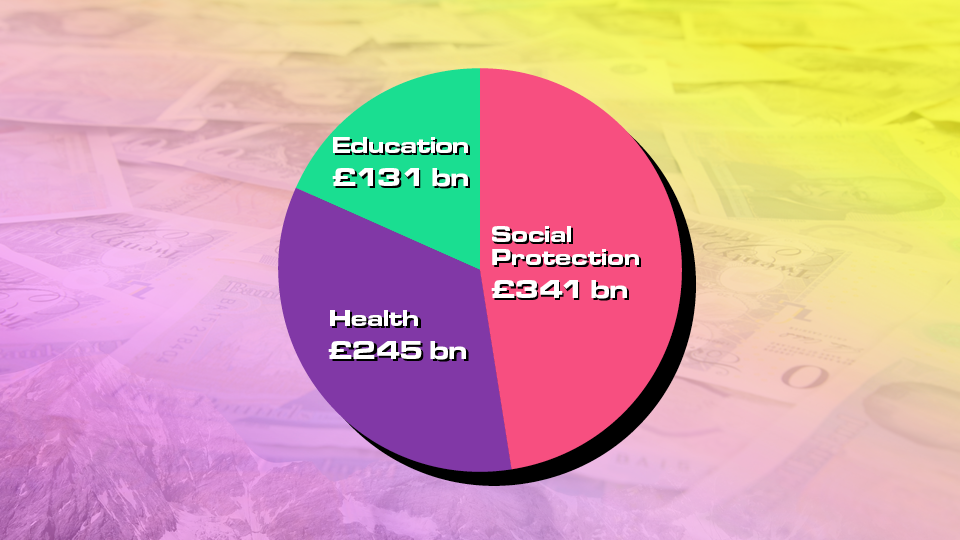

In the UK, nearly £1 trillion (that’s 1 million million!) is paid in tax each year! It mostly gets paid to local councils and His Majesty’s Revenue & Customs (HMRC). The government then decides how to spend the money, and there are three main areas of spending:

- Social Protection. £341 billion is expected to be spent in 2023/24, and that will pay for things like free school meals, housing benefits, and pensions.

- Health. £245 billion is expected to be spent in 2023/24, and that will pay for things like building new hospitals, buying medicines and vaccines, and paying the salaries of nurses and doctors.

- Education. £131 billion is expected to be spent in 2023/24, and that will not only go towards schools and colleges but also nurseries, pre-schools and universities.

Never stop learning

Just by going through this article, you can now feel more confident and knowledgeable when it comes to the issue of tax. If you’re interested in learning even more about finance, then check out these posts on the blog.

Looking to build your skills?

Why not grab your place on the ‘Boss It’ NCS away from home experience. It’s a great opportunity to get all the tools and inspiration you need to take control of your career and learn more about money matters!

Time for another article?

Take a look at All About Employability or Creating a Weekly Budget.